Medicare Advantage

In 2003 CMS introduced a second way to cover costs associated with Original Medicare. Medicare Part C, also known as Medicare Advantage Plans. Once enrolled, you are removed from Original Medicare (Parts A and B). You are still guaranteed the same hospital and medical insurance, but you now have a private health plan with an insurance company. Normally these plans come with network restrictions (HMOs & PPOs) that can change from year to year. Your out-of-pocket costs can change over time and you cannot purchase Medicare Supplement Insurance to cover extra costs.

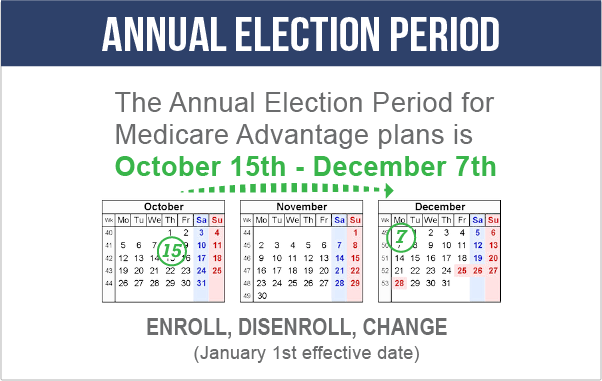

Because Medicare Advantage plans are optionally renewable and because doctor/drug participation in their networks change every year, you can change your MA plan from year to year during Annual Enrollment Period (AEP), October 15 – December 7.

Medicare Advantage plans often incorporate additional benefits, including Part D coverage and extras such as routine dental/vision, tele-health, transportation, OTC pharmacy credits, and sometimes even a buyback of part of your Part B premium (yes, you have to pay the Part B premium in addition to your Advantage premium, even if you are in a “zero-premium” Advantage plan).

Some Advantage plans have deductibles, others do not. All Medicare Advantage plans are structured around co-insurance but must limit in-network maximum out of pockets (not counting prescriptions) to no more than $6,700 for HMOs and $10,000 for PPOs in 2020. The primary reason Medicare beneficiaries choose Medicare Advantage plans is because of the low to zero premiums and the extra benefits. While inexpensive to own, the maximum out of pocket limits may be difficult to cover with chronic and/or catastrophic medical conditions.

Original Medicare with Medigap or a Medicare Advantage Plan? Which One is Best?

There is no “one-size-fits-all” when it comes to Medicare plan options. Two of my clients are spouses; one has a zero-premium Medicare Advantage plan, while the other has Original Medicare plus a comprehensive Medigap plan and a Part D prescription plan.

The one with the MA plan would rather save money on premiums and does not mind the higher out-of-pocket exposure and limited provider network. The other spouse is willing to pay higher premiums in trade for lower-out-of-pocket costs and nationwide provider choice that comes with Original Medicare.

Ultimately, the choice between Medicare Advantage and Original Medicare with Medigap is a personal one that reflect each applicant’s health, risk tolerance, and approach to personal finances.

Neither option is universally better or worse than the other, and a quality advisor will help you determine which option is best for you. A good advisor will work with you to understand your specific needs and goals, show you multiple plan options, and will devote sufficient time to answering your questions. This process should not make you feel pressured.

Medicare Advantage Broker, You Can Trust

Medicare 863 is devoted to working with seniors and promises to be with them every step of the way. As a Medicare Advantage Insurance Broker, Susan M. Tighe helps her clients find a Medicare Advantage plan that best fits their personalized needs and budget. She also educate her clients about how Medicare works because Medicare beneficiaries often feel frustrated after trying to read the Medicare handbook. Besides, she has access to different insurers so that she can provide you the best Medicare plan as an individual.

We are currently servicing In Yavapai County, Flagstaff, Prescott, Cottonwood, Camp Verde, & Sedona, AZ

Contact Susan Tighe for help today at (602)-705-1462! Susan lives locally and is focused on serving the Yavapai (area code 863) senior population, and she can guide you through your options.