Medicare Explained

What is Medicare?

Medicare is health insurance, managed by the Federal government, for people age 65 or older, people with certain disabilities, and anyone with End-Stage Renal Disease. In order to qualify for Medicare you or your spouse must have worked in the U.S. for at least 10 years.

Medicare offers four types of insurance, Part A, B, C and D.

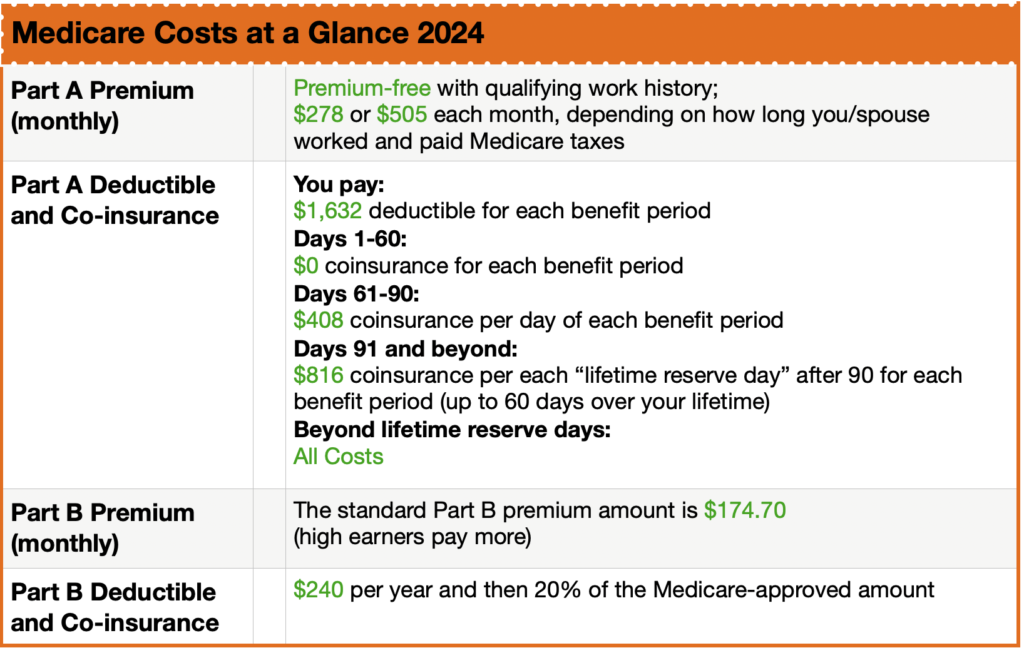

Medicare Part A (Hospital Insurance)

- Helps pay hospital bills after deductible has been met.

- Helps cover expenses for care received through a skilled nursing facility, hospice, and home health care, if certain conditions are met.

Medicare Part B (Medical Insurance)

- Pays 80% for doctors’ services, and outpatient hospital care after deductible is met.

- Pays 80% for ambulance services after deductible is met.

- Pays 80% for covered medical equipment or supplies after deductible is met.

- Pays 100% for certain preventative services (no deductible) and 80% for other covered preventative services (deductible depends on service).

Medicare Part C (Medicare Advantage Plans)

- Offered by private insurance companies under contract with Medicare.

- Provides all of Part A and Part B coverage and may offer extra coverage, such as dental, vision, hearing, and/or wellness programs.

- Most include Part D drug coverage.

- Most Medicare Advantage plans use a network of doctors and hospitals. Some of these (PPO for example) allow you to go out-of-network but you pay a larger portion while others (HMO for example), do not pay at all for out-of-network services, except in an emergency or urgent care situation.

Medicare Part D (Prescription Drug Coverage)

- Offered by private Medicare-approved companies.

- Helps cover the cost of prescriptions drugs.

Contact Susan Tighe for help today at (602)-705-1462! Susan lives locally and is focused on serving the Yavapai (area code 863) senior population, and she can guide you through your options.

Medicare Explained

What is Medicare?

Medicare is health insurance, managed by the Federal government, for people age 65 or older, people with certain disabilities, and anyone with End-Stage Renal Disease. In order to qualify for Medicare you or your spouse must have worked in the U.S. for at least 10 years.

Medicare offers four types of insurance, Part A, B, C and D.

Medicare Part A (Hospital Insurance)

- Helps pay hospital bills after deductible has been met.

- Helps cover expenses for care received through a skilled nursing facility, hospice, and home health care, if certain conditions are met.

Medicare Part B (Medical Insurance)

- Pays 80% for doctors’ services, and outpatient hospital care after deductible is met.

- Pays 80% for ambulance services after deductible is met.

- Pays 80% for covered medical equipment or supplies after deductible is met.

- Pays 100% for certain preventative services (no deductible) and 80% for other covered preventative services (deductible depends on service).

Medicare Part C (Medicare Advantage Plans)

- Offered by private insurance companies under contract with Medicare.

- Provides all of Part A and Part B coverage and may offer extra coverage, such as dental, vision, hearing, and/or wellness programs.

- Most include Part D drug coverage.

- Most Medicare Advantage plans use a network of doctors and hospitals. Some of these (PPO for example) allow you to go out-of-network but you pay a larger portion while others (HMO for example), do not pay at all for out-of-network services, except in an emergency or urgent care situation.

Medicare Part D (Prescription Drug Coverage)

- Offered by private Medicare-approved companies.

- Helps cover the cost of prescriptions drugs.

Contact Susan Tighe for help today at (602)-705-1462! Susan lives locally and is focused on serving the Yavapai (area code 863) senior population, and she can guide you through your options.