Medicare Part A Costs (Hospital)

Part A Monthly Premium

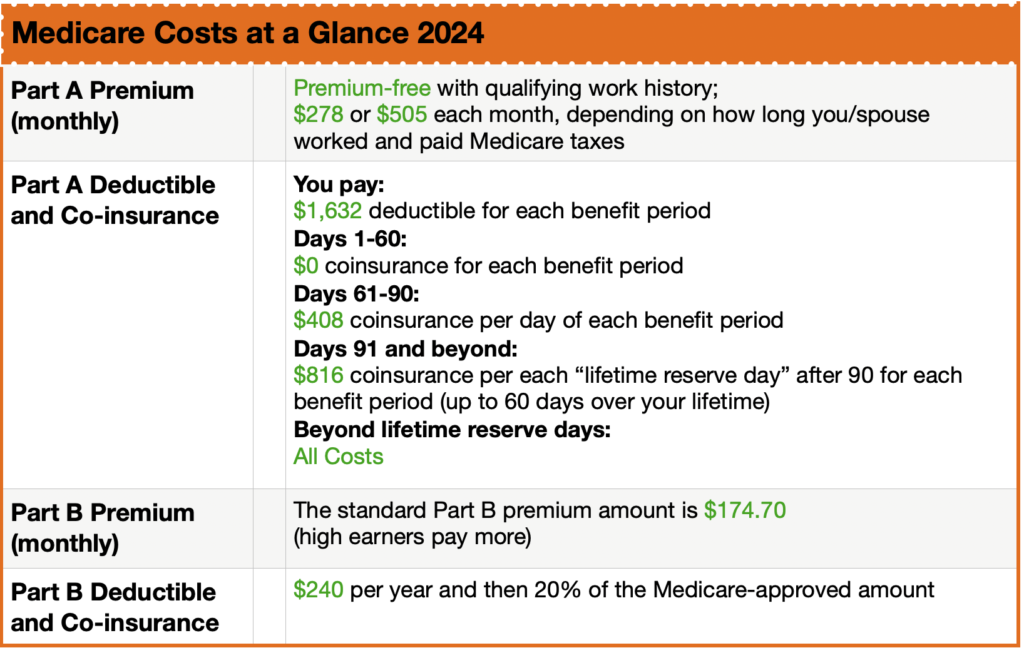

Most people don’t pay a Part A premium because they paid Medicare taxes while working. If you don’t get premium-free Part A, you pay up to $505 each month. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Hospital Stay

In 2024, you pay

- $1,632 deductible per benefit period

- $0 for the first 60 days of each benefit period

- $408 per day for days 61-90 of each benefit period

- $816 per "Lifetime reserve day" after day 90 of each benefit period (up to a maximum of 60 days over your lifetime)

Skilled Nursing Facility Stay

In 2024, you pay

- $0 for the first 20 days of each benefit period

- $204 per day for days 21-100 of each benefit period

- All costs for each day after day 100 of the benefit period

Medicare Part B Costs (Medical)

Most people pay the standard Part B monthly premium amount ($174.70 in 2024). Social Security will tell you the exact amount you’ll pay for Part B in 2024.

You pay the standard premium amount if:

- You enroll in Part B for the first time in 2024.

- You don’t get Social Security benefits.

- You’re directly billed for your Part B premiums.

- You have Medicare and Medicaid, and Medicaid pays your premiums.

(Your state will pay the standard premium amount of $174.70 in 2024.)

If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard Part B premium and an income-related monthly adjustment amount.

Part B deductible—$240 per year

Medicare Part D Premiums (Drug Plans)

The chart below shows your estimated drug plan monthly premium based on your income. If your income is above a certain limit, you’ll pay an income-related monthly adjustment amount in addition to your plan premium.

2024 Part D national base beneficiary premium — $34.70

Medicare uses the national base beneficiary premium to estimate the Part D late enrollment penalty and the income-related monthly adjustment amounts listed in the table above. This amount can change each year. If you pay a late enrollment penalty, these amounts may be higher.

2024 Part D Benefits

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage. Between 2023 and 2024, the parameters of the standard benefit are rising, which means Part D enrollees will face higher out-of-pocket costs for the deductible and in the initial coverage phase, as they have in prior years, and will have to pay more out-of-pocket before qualifying for catastrophic coverage.

In a change from prior years, however, beneficiaries in 2024 will no longer pay 5% coinsurance once they qualify for catastrophic coverage, due to a provision in the Inflation Reduction Act that eliminated this cost-sharing requirement.

The standard benefit amounts are indexed to change annually based on the rate of Part D per capita spending growth, and, except for 2014, have increased each year since 2006 (Figure 5):

- The standard deductible is increasing from $505 in 2023 to $545 in 2024.

- The initial coverage limit is increasing from $4,660 to $5,030.

- The out-of-pocket spending threshold is increasing from $7,400 to $8,000 (equivalent to $12,447 in total drug spending in 2024, up from $11,206 in 2023). This amount includes what beneficiaries themselves pay out of pocket plus the value of the manufacturer discount on the price of brand-name drugs in the coverage gap phase. Based on the $8,000 catastrophic threshold for 2024, enrollees themselves will pay about $3,300 out of pocket before reaching the catastrophic phase (this estimate is based on using brand drugs only).

Get help from an expert!

Medicare premium increases happen almost every year, an expert ca figure out exactly what your Medicare costs will be. Many people find that Medicare and a supplement costs less than private insurance they had prior to Medicare. Either way, you’ll want to get some estimates of your Medicare costs before you retire. This way you can plan ahead to have enough savings for the future.

The fact is that most people do pay Medicare premiums. Fortunately, we can put together a Medicare cost estimate so that you can plan ahead.

Get your questions about the costs for Medicare answered by an expert so you understand the changes and can make an effective plan for YOUR healthcare spending.

- There are no additional fees, your premium will be the same as if you had bought the policy directly from the carrier

- An advisor can save you money on your monthly premiums by comparing plans with all carriers vs just one carrier

- Advisors can help keep you up to date and informed on any changes that happen annually

- A relationship with a LOCAL advisor can be your go-to resource for years to come

- They can help you with Medicare claims

- They will help you get a better price than you might be able to find on your own

- You will get non-biased opinion on all your Medicare options

Additional Information

For detailed information on costs and enrollment penalties:

- Visit Medicare.gov/coverage to get more detailed Medicare cost information by service.

- Visit Medicare.gov/basics/costs/medicare-costs/avoid-penalties to learn how Medicare calculates late enrollment penalties.

- Call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

You have the right to get Medicare information in an accessible format, like large print, Braille, or audio. You also have the right to file a complaint if you feel you’ve been discriminated against. Visit Medicare.gov/about-us/accessibility-nondiscrimination-notice, or call 1-800-MEDICARE (1-800-633-4227) for more information. TTY users can call 1-877-486-2048.

Contact Susan Tighe for help today at (602)-705-1462! Susan lives locally and is focused on serving Yavapai County's seniors. As your local resource, she will guide you through your options.