Everything you want

to know about

Medicare

Preparation is the best way to begin your Medicare journey. The first step is understanding what Medicare is and knowing your options. You are not alone! We understand that it can be overwhelming and we are here to help you navigate the way.

Medicare Made Easy

Getting started can be the hardest part! That's why we have defined four simple steps that will set you on your way to choosing the plan that’s best for you. Medicare 863 believes that the first step to setting up affordable health insurance is knowledge. We are here to help!

Register for FREE Webinar

Do your Homework

Talk to an agent

Compare Plans

Let's answer the big questions first.

Before you enroll in a plan, you need to understand what Medicare is and the fundamentals of how it works.

New to Medicare?

The best way to get your feet on the ground is by watching our educational webinar. In this free virtual event, you’ll learn about the different parts of Medicare and how they work together to provide your healthcare coverage. You’ll also learn what your options are and when you need to enroll to ensure uninterrupted care.

Welcome to Medicare!

Understanding Original Medicare

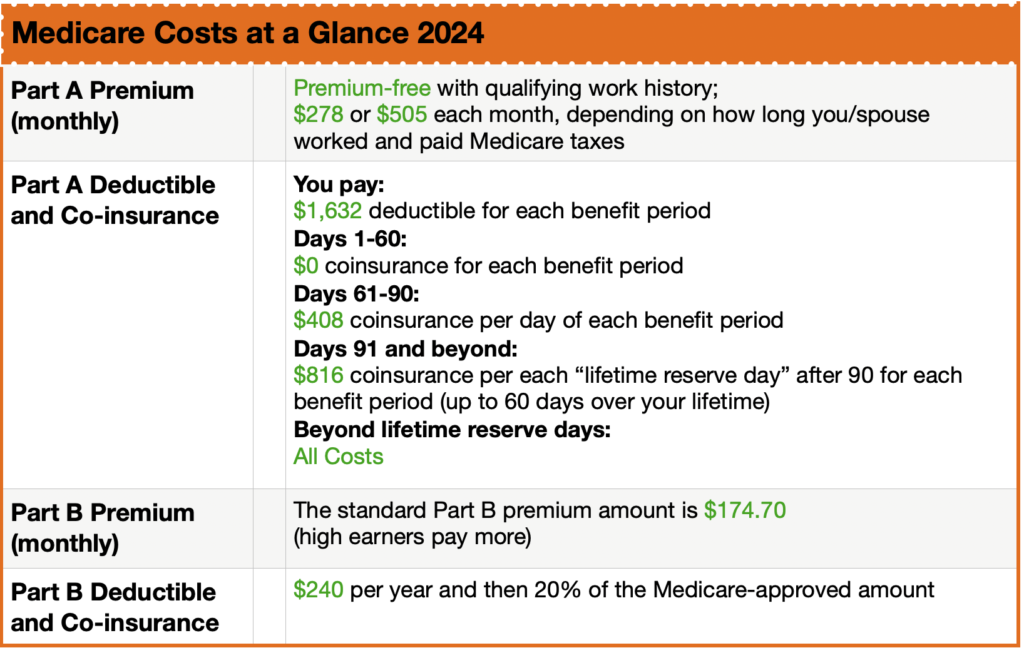

Original Medicare consists of Part A (Hospital Insurance) and Part B (Medical Insurance). For an additional cost, you can purchase Medicare Supplement Insurance (Medigap) and Part D (Prescription Drug Coverage) to help cover what Original Medicare does not.

How to enroll in Original Medicare (Parts A & B)

The four parts of Medicare

Medicare is comprised of 4 parts, each one is designed to cover specific services. You can combine certain parts in order to meet your healthcare needs.

Part AHospital Insurance

Hospital InsuranceMedicare Part A is offered to those who paid Medicare taxes while working. For most, it is not necessary to pay a monthly premium for the coverage.- Inpatient Hospital Care

- Skilled Nursing Care

- Hospice Care

- Home Health Care

Part BMedicare Insurance

Part B covers 80% of all medical costs not covered by Part A. However, unlike Part A, you need to elect Part B when you turn 65. Part A and B together make up Original Medicare.- Doctor Visits

- Lab Tests

- Medical Equipment

- Preventative Services

Part CMedicare Advantage

Medicare Advantage plans are offered by private insurers and approved by Medicare. They often provide extra benefits and access to Part D coverage.- Includes Parts A and B

- Usually Includes Part D

- May include Dental, Vision

Part DPrescription Coverage

Part D offers prescription drug plans from private companies approved by Medicare. Prescription drug coverage is optional and members who want to receive the benefits must pay a monthly premium.- Prescription Drugs

More about Original Medicare

Once you are enrolled in Part A and Part B, it’s time to make sure you have the best coverage for you. Here are a few common questions about Original Medicare.

What is Medicare Advantage?

Medicare Advantage, or Part C, is a separate pathway to receiving your Medicare benefits. These plans include Part A (Hospital Insurance) and Part B (Medical Insurance) and usually include Part D (Prescription Drug Coverage). They may also include dental, vision, and other benefits.

How to Enroll in Medicare Advantage

More about Medicare Advantage

Different Medicare Advantage plans offer different benefits. Here are a few common questions about Medicare Advantage.

Do I Need a Medicare Insurance Advisor?

Medicare is full of jargon, similar-sounding plans, deadlines, and hidden costs. It's a steep learning curve, and a trusted independent Medicare advisor can save you money, time and frustration.

Medicare advisors can provide information about all your Medicare options near you. What most new Medicare beneficiaries don’t realize is working with an advisor is free. An advisor knows different carrier guidelines, rate increases and limitations that you won’t easily find online.

Did you know that different companies charge different premiums for the same policy? An advisor is paying attention to Medicare news, guidelines and changes every single day. They will spot issues and can give you advice based on experience.

Advisors can help you decide which level of coverage is best for you, based on your needs and budget.

- There are no additional fees, your premium will be the same as if you had bought the policy directly from the carrier

- An advisor can save you money on your monthly premiums by comparing plans with all carriers vs just one carrier

- Advisors can help keep you up to date and informed on any changes that happen annually

- A relationship with a LOCAL advisor can be your go-to resource for years to come

- They can help you with Medicare claims

- They will help you get a better price than you might be able to find on your own

- You will get non-biased opinion on all your Medicare options

Contact Susan Tighe for help today at (602)-705-1462! Susan lives locally and is focused on serving Yavapai County's seniors. As your local resource, she will guide you through your options.