Medicare Supplement Plans (Medigap)

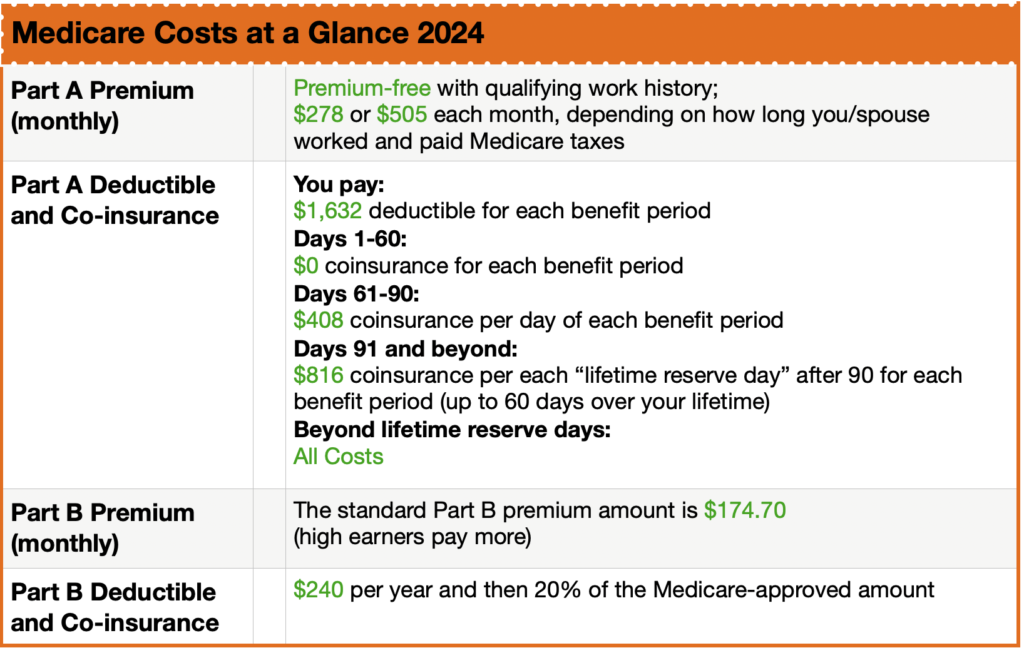

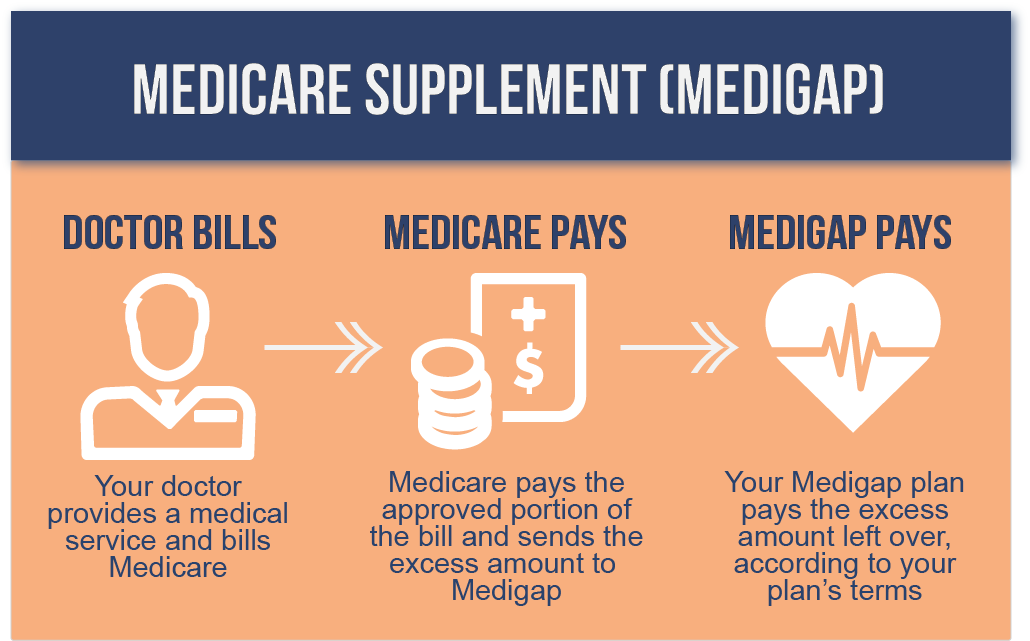

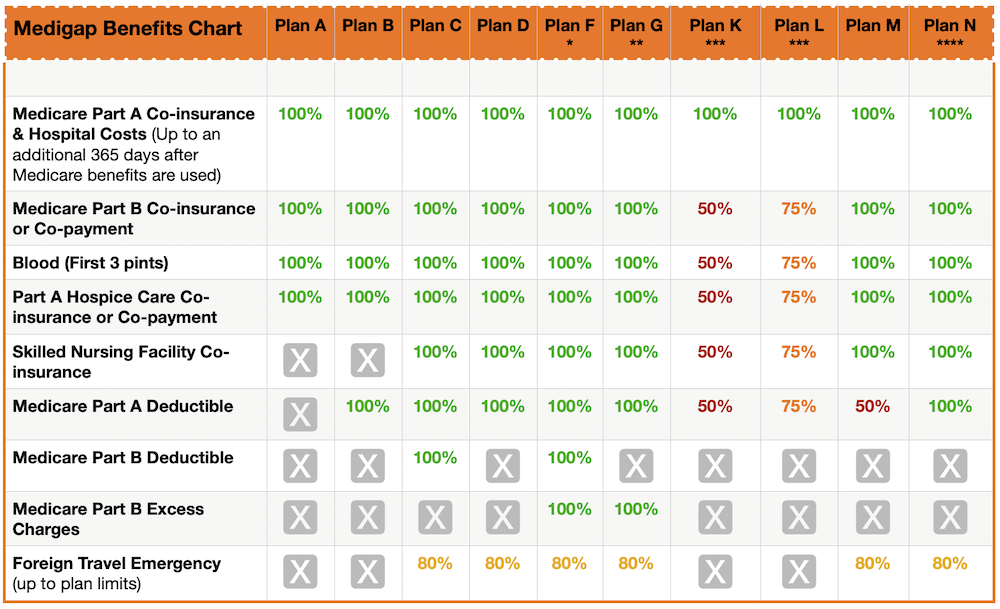

A Medicare Supplement Insurance (Medigap) policy is health insurance that can help pay some of the health care costs that Original Medicare does not cover, such as outlined premiums, co-insurance, co-payments, or deductibles. Private insurance companies sell Medigap policies. All Medigap policies must follow federal and state laws designed to protect you, and policies must be clearly identified as “Medicare Supplement Insurance”. Each standardized Medigap policy offers the same basic benefits no matter which insurance company sells it.

Medigap plans are secondary to Original Medicare. You can see any doctor or hospital that accepts Medicare. More than 9 in 10 physicians and hospitals accept Original Medicare. Remember, the Federal Government is the primary payor of your Medicare benefits; your Medigap policy follows.

Generally, Medigap policies do not cover long-term care, routine vision or dental care, although some Medigap policies offer benefits Original Medicare does not cover, like a gym membership, or preventive healthcare and hearing loss testing. Insurance companies that sell Medigap policies must have specific benefits so you can compare them easily. Insurance companies that sell Medigap policies do not have to offer every Medigap plan.

If you are in your Medigap Initial Enrollment Period (3 months prior to your birthday month, your birthday month, and the 3 months after your birthday month), insurance companies must sell you a Medigap policy if you want one, even if you have health problems. There are other times you have a “guaranteed issue” right. You may be able to buy a Medigap policy outside of those designated periods, but the insurance company can deny you a Medigap policy based on your health when it is not your Initial Enrollment Period (IEP) or Special Enrollment Period (SEP).

There are premiums for Medigap plans. The costs vary by plan and insurance company. The primary reason Medicare beneficiaries choose Medigap policies to supplement Original Medicare is because of their freedom to choose any doctor or hospital in the USA that accepts Medicare.

If you choose a Medigap policy, you will typically add a stand-alone Part D plan. More on Part D plans later.

Reliable and Affordable Medicare Supplement Insurance Brokers in Yavapai County

Working with Susan M. Tighe comes with a lot of advantages. Because as a Medicare Supplemental Insurance Broker, she will give you an unbiased opinion on the best plan option for you and your budget. She has the expertise and knowledge to pinning out any problems you may have with your Medicare policy. She keeps her clients up to date on the ins and outs of the Medicare market. We can schedule a free consultation to find the healthcare option that makes sense for you and your loved ones.