HEALS Act 2020

August 9, 2020

Premium Rate Increases

June 7, 2022Original Medicare Basics

Medicare was created in 1965 to help pay medical bills under the administration of Lyndon B Johnson. It is run by the Centers for Medicare and Medicaid Services (CMS). The program has had a few overhauls over the years including the Medicare Modernization Act of 2003, and the Affordable Care Act of 2010. Original Medicare is a Federal health insurance program for seniors and other individuals with certain medical conditions and disabilities. Because Original Medicare is Federally run, eligibility guidelines and services are normally the same throughout the country. Medicare is not to be confused with Medicaid which is a joint Federal and State health insurance program. Medicaid is only available for people with extremely limited resources. Medicaid programs vary from state to state, but each are subject to Federal rules and regulations.

Original Medicare is comprised of 4 parts. The different parts of Medicare help cover specific services.

- Part A (Hospital Insurance) Helps cover:

- Inpatient care in hospitals

- Skilled nursing facility care

- Hospice care

- Home health care *the primary payor for these services is the Federal Government

- Part B (Medical Insurance) Helps cover:

- “Welcome to Medicare” visit

- Many preventive services (on a schedule)

- Inpatient and outpatient doctor services

- Surgical services and supplies

- Speech and Physical Therapy

- Diagnostic tests

- Durable medical equipment

- Ambulance Services (by air or bus) *the primary payor for these services is the Federal Government

- Part C (Medicare Advantage Plans) Helps cover:

- Hospital Insurance

- Medical Insurance

- Prescription drug coverage

- Extra coverage *Part C plans are run by private insurance companies that follow rules set by Medicare

- Part D (Prescription drug coverage) Helps cover:

- Cost of prescription drugs (including many, but not all, recommended shots or vaccines) *Part D plans are run by private insurance companies that follow rules set by Medicare

Costs Associated with Original Medicare

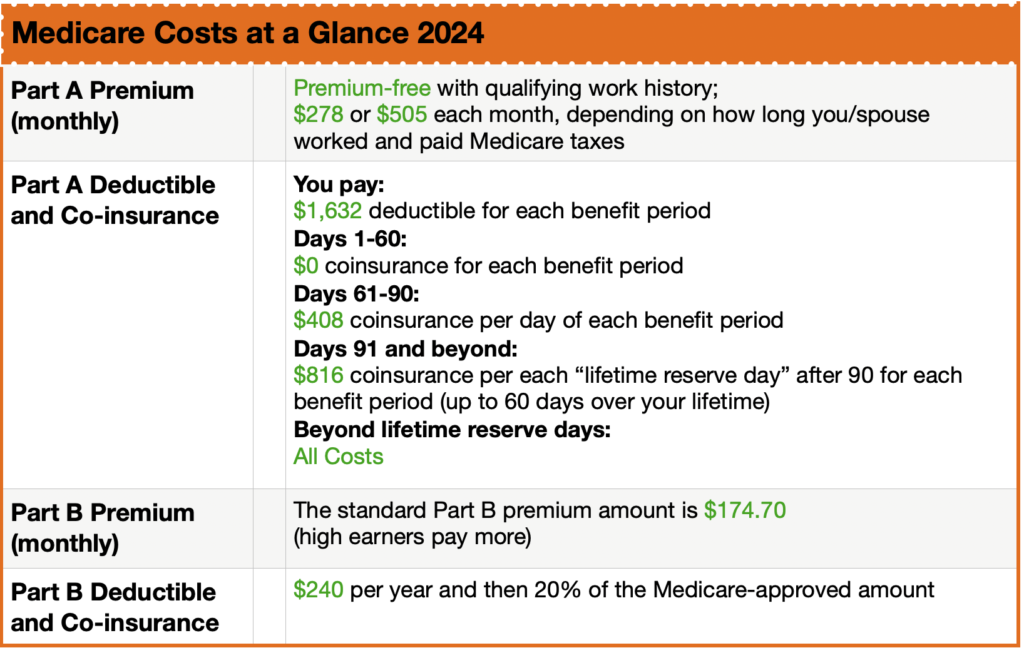

Most of us do not pay a monthly premium for Part A. A premium is the amount you pay for your health insurance every month. This is sometimes called premium-free Part A. If you or your spouse has worked for 40 quarters or more (10 years) then you qualify for a premium-free Part A. It’s not really free, but pre-paid by the FICA taxes you paid while working. Part A does have a deductible. A deductible is the amount you pay for covered health care services before the insurance plan starts to pay. Part A also has co-insurance and co-payments. Co-insurance and co-payments are the costs or percentage of costs for a covered health care service you pay after you have paid your deductible. Premiums, deductibles, and co-insurance costs change from year to year. For the purpose of this article I will be using 2021 examples. These costs will likely be different beginning January 1, 2022.

Part A has a deductible if you are admitted to hospital. Instead of an annual deductible period, the Part A deductible is a per 60-day benefit period. If you are hospitalized today, stay for three days, and are re-admitted again within 60 days you only pay a single deductible: $1484. If you are re-admitted beyond the 60-day benefit period, you will be subject to the $1484 deductible again, and so on and so forth.

Once the deductible has been paid, and you are in the hospital for consecutive days you pay $0 co-insurance for days 1-60. If you are in the hospital on day 61-90 you pay $371 in co-insurance, and if you are there on day 91 and beyond you pay $742 in co-insurance.

These are the primary costs (“gaps”) in Part A that a Medicare beneficiary looks to cover in other ways.

Part B does have a premium. Most new 2021 Medicare enrollees pay $148.50 monthly for Medicare Part B and have no additional income-related monthly adjustment for Part B. However, if your modified adjusted gross income, as reported on your IRS tax return from two years ago (the most recent information provided to Social Security by the IRS), is above a certain limit, you may pay more. The amount you pay can change each year depending on your income, so you will be contacted by Social Security if you are required to pay more. If you do not agree with the amount you are required to pay for your Part B premium (for example, you are now retired and so your income is not what it was two years ago), you can appeal their decision in writing.

If your yearly income in 2019 was $88,000 or less (Filed individually), or $176,000 or less (Filed jointly), you will pay the standard Part B premium of $148.50.

The Part B deductible is $203. Once this annual deductible is met, you pay 20% co-insurance of the Medicare-approved amount for Part B services. 20% of the Medicare-approved amount is usually manageable for typical care. However, there is no cap on the 20% co-insurance. If you have a chronic or catastrophic health problem, that 20% may be financially untenable.

That 20% is the primary cost (“gap”) in Part B that a Medicare beneficiary looks to cover in other ways.

This article is not meant to provide all the potential costs associated with Parts A & B, but to outline the most common gaps in Original Medicare. A Medicare beneficiary may choose to have Original Medicare only, but most choose to cover those gaps in one of two ways.

Medigap

A Medicare Supplement Insurance (Medigap) is health insurance that can help pay some of the health care costs that Original Medicare does not cover, like the above outlined premiums, co-insurance, co-payments, or deductibles. Private insurance companies sell Medigap policies. All Medigap policies must follow federal and state laws designed to protect you, and policies must be clearly identified as “Medicare Supplement Insurance”. Each standardized Medigap policy must offer the same basic benefits no matter which insurance company sells it.

Medigap plans are secondary to Original Medicare. You can see any doctor or hospital that accepts Medicare. More than 9 in 10 physicians and hospitals accept Original Medicare. Remember, the Federal Government is the primary payor of your Medicare benefits; your Medigap policy follows.

Generally, Medigap policies do not cover long-term care, routine vision or dental care, although some Medigap policies offer benefits Original Medicare does not cover, like a gym membership, or preventive healthcare and hearing loss testing. Insurance companies that sell Medigap policies must have specific benefits so you can compare them easily. Insurance companies that sell Medigap policies do not have to offer every Medigap plan.

If you are in your Medigap Initial Enrollment Period (3 months prior to your birthday month, your birthday month, and the 3 months after your birthday month), insurance companies must sell you a Medigap policy if you want one, even if you have health problems. There are other times you have a “guaranteed issue” right. You may be able to buy a Medigap policy outside of those designated periods, but the insurance company can deny you a Medigap policy based on your health when it is not your Initial Enrollment Period (IEP) or Special Enrollment Period (SEP).

There are premiums for Medigap plans. The costs vary by plan and insurance company. The primary reason Medicare beneficiaries choose Medigap policies to supplement Original Medicare is because of their freedom to choose any doctor or hospital in the USA that accepts Medicare.

If you choose a Medigap policy, you will typically add a stand-alone Part D plan. More on Part D plans later.

Medicare Advantage Plans (Part C)

In 2003 CMS introduced a second way to cover costs associated with Original Medicare. Medicare Part C, also known as Medicare Advantage Plans. Once enrolled, you are removed from Original Medicare (Parts A and B). You are still guaranteed the same hospital and medical insurance, but you now have a private health plan with an insurance company. Normally these plans come with network restrictions (HMOs & PPOs) that can change from year to year. Your out-of-pocket costs can change over time and you cannot purchase Medicare Supplement Insurance to cover extra costs.

Because Medicare Advantage plans are optionally renewable and because doctor/drug participation in their networks change every year, you can change your MA plan from year to year during Annual Enrollment Period (AEP), October 15 – December 7.

Medicare Advantage plans often incorporate additional benefits, including Part D coverage and extras such as routine dental/vision, telehealth, transportation, OTC pharmacy credits, and sometimes even a buyback of part of your Part B premium (yes, you have to pay the Part B premium in addition to your Advantage premium, even if you are in a “zero-premium” Advantage plan).

Some Advantage plans have deductibles, others do not. All Medicare Advantage plans are structured around co-insurance but must limit in-network maximum out of pockets (not counting prescriptions) to no more than $6,550 for HMOs and $11,300 for PPOs in 2021. The primary reason Medicare beneficiaries choose Medicare Advantage plans is because of the low to zero premiums and the extra benefits. While inexpensive to own, the maximum out of pocket limits may be difficult to cover with chronic and/or catastrophic medical conditions.

Original Medicare with Medigap or a Medicare Advantage Plan? Which One is Best?

There is no “one-size-fits-all” when it comes to Medicare plan options. Two of my clients are spouses; one has a zero-premium Medicare Advantage plan, while the other has Original Medicare plus a comprehensive Medigap plan and a Part D prescription plan.

The one with the MA plan would rather save money on premiums and does not mind the higher out-of-pocket exposure and limited provider network. The other spouse is willing to pay higher premiums in trade for lower-out-of-pocket costs and nationwide provider choice that comes with Original Medicare.

Ultimately, the choice between Medicare Advantage and Original Medicare with Medigap is a personal one that reflect each enrollee’s health, risk tolerance, and approach to personal finances.

Neither option is universally better or worse than the other, and a quality advisor will help you determine which option is best for you. A good advisor will work with you to understand your specific needs and goals, show you multiple plan options, and will devote sufficient time to answering your questions. This process should not make you feel pressured.

Part D Explained

Medicare Part D is a federal program administered through private insurance companies. These companies offer retail prescription drug coverage to Medicare beneficiaries. Beneficiaries can enroll in a standalone Part D drug plan that goes alongside their Original Medicare benefits, or they can choose a Part D drug plan that is built-in to a Part C Medicare Advantage plan.

Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier’s network of pharmacies to purchase your prescription medications. Instead of paying full price, you will pay a copay or percentage of the drug’s cost. The insurance company will pay the rest.

Your Part D insurance card will be separate from your Medigap plan.

Medicare Part D plans all follow federal guidelines. Each insurance carrier must submit its plan outline to the Centers for Medicare and Medicaid Services annually for approval.

To improve your understanding of Medicare Part D, let’s look at the basic way that each Part D plan works:

There are 4 stages to a Part D drug plan, as follows:

STAGE 1: Annual Deductible

In 2021, the allowable Medicare Part D deductible is $445. Plans may charge the full Part D deductible, a partial deductible, or waive the deductible entirely. You will pay the network discounted price for your medications until your plan tallies that you have satisfied the deductible. After that, you enter initial coverage.

STAGE 2: Initial Coverage

During this stage of Part D drug coverage, you will pay a copay for your medications based on the drug formulary. Each drug plan will separate its medications into tiers. Each tier has a copay amount that you will pay. For example, a plan might assign a $7 copay for a Tier 1 generic medication. Maybe a Tier 3 is a preferred brand name for a $40 copay, and so on. The insurance company tracks the spending by both you and the insurance company until you have together spent a total of $4130 in 2020.

STAGE 3: The Coverage Gap

After you’ve reached the initial coverage limit for the year, you enter the coverage gap. During the gap, you will pay only 25% of the retail cost of your medications. (This is so much better than in 2006 when many people had to pay 100% of their drugs in the gap.) Your gap spending will continue until your total out of pocket drug costs have reached $6550 in 2021.

Please note that to get into the gap, Medicare tracks the total costs of what you and the insurance company have spent, but to get OUT of the gap, they are counting only what you have paid in deductibles, copays and gap spending that year, plus manufacturer discounts. They do not count anything the federal government contributes.

STAGE 4: Catastrophic Coverage

After you’ve reached the end of the coverage gap, your plan will kick in to pay 95% of the costs of your formulary medications for the rest of the year. This feature in Part D drug plans helps you limit your potential spending if you have expensive medications.

Should You Skip Part D?

Part D is optional, but why risk it when most states have plans available for as low as around $15/month? Keep in mind that Part D is insurance not just for your medications today. It also insures you for any new medications that your doctors prescribe in the future. There are hundreds of medications that cost hundreds or thousands of dollars per year. These would be difficult to afford without coverage.

Like Medicare Advantage plans, Prescription Drug plans change from year to year. Only 1 in 10 Medicare Beneficiaries check annually to verify that they are enrolled in the most cost-effective plan. Every Annual Enrollment Period (AEP), October 15 – December 7 you need to compare plans to ensure you are in the best plan for you beginning on January 1 of the following year.

Do I Need a Medicare Insurance Advisor?

Medicare insurance advisors can provide information about all your Medicare options near you. What most new Medicare beneficiaries don’t realize is working with an advisor is free; also, he/she can save you money, time, and frustration. An advisor knows different carrier guidelines, rate increases, and limitations that you won’t easily find online.

- There are no additional fees, your premium will be the same as if you had bought the policy directly from the carrier

- An advisor can save you money on your monthly premiums by comparing plans with all carriers vs just one carrier

- Advisors can help keep you up to date and informed on any changes that happen annually

- They can help you with Medicare claims

- They will help you get a better price than you might be able to find on your own

- Can provide a non-biased opinion on all your Medicare options

Medicare is full of jargon, similar-sounding plans, deadlines, and hidden costs. If you never dealt with that before, you have a steep learning curve ahead of you. That’s where an advisor comes into play.

A licensed advisor can quickly and efficiently search dozens of plans from different insurers, saving you time. Many enrollees don’t realize that different companies charge different premiums for the same policy.

Advisors can help you decide which level of coverage is best for you, based on your needs and budget. They do this every day. They will spot issues and can give you advice based on experience.