Original Medicare Basics

June 24, 2021New Legislation is on the Table for Coronavirus Relief and may Include a Benefit for Medicare Beneficiaries

Today, many Americans, including seniors, are struggling financially right now. The future is unknown due to COVID-19.

In response to the economic uncertainty, US lawmakers have passed multiple stimulus bills, and they are currently negotiating another one. Right now, Republicans have put forth a plan called the Health, Economic Assistance, Liability Protection and Schools Act, or HEALS Act, to offer additional financial relief. This Act would, among other things, provide a second stimulus check to millions of Americans.

But that is not the only assistance it provides to Social Security retirees; it also offers a little extra financial relief for Medicare beneficiaries.

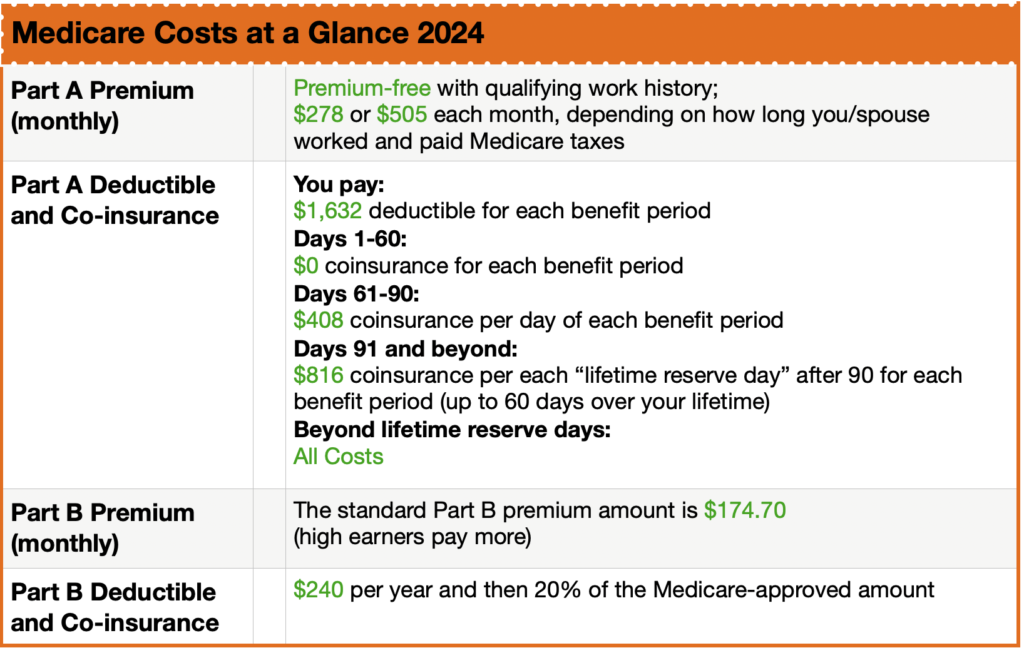

Medicare Part B provides insurance coverage to more than 60 million Americans, most of whom are over 65. Medicare beneficiaries pay premiums for Part B as well as deductibles before the insurance starts paying. In 2020, the standard premium paid by most Medicare beneficiaries is $144.60 a month, although some higher-income seniors pay more.

Premium prices for Medicare Part B have gone up every year since 1966. For example, in 2019, the standard premium for Part B was $135.50. The HEALS Act would freeze premiums or deductibles from increasing in 2021.

If this year's prices are locked in for 2021, Medicare beneficiaries would avoid increases to both premiums and deductibles.

Under the HEALS Act, Medicare beneficiaries would have to pay an extra $3 monthly surcharge, but this would be less costly than the premium and deductible increases would have been.

This means Medicare beneficiaries (especially those on a fixed income), will not have to pay more for their health insurance in 2021.

Freezing Medicare Part B premiums may be especially valuable to Social Security retirees next year since they may only get a small cost-of-living adjustment (COLA) or potentially no cost of living adjustment in 2021 thanks to the coronavirus' impact on the economy. Most people on Social Security have their Medicare premiums taken directly out of their Social Security checks. And if they get only a small annual raise to their benefits (or none at all), Medicare premiums may go up more than their retirement income does.

The HEALS Act is not a Done Deal

There is no guarantee the HEALS Act will pass and, in fact, many Democrats have objected to some of the key components of the GOP's proposal.

However, it is likely lawmakers will eventually find some compromise so they can pass a coronavirus relief bill. And protections from rising Medicare premiums will likely be included since it is an idea with bipartisan support.

Of course, there is conflict in Washington over how to proceed, so there's still a chance no action will be taken, and Medicare beneficiaries may be left to deal with rising medical expenses. To help ensure you are prepared for this possibility, it might be a good idea to shore up your emergency fund now. You may also want to make sure you aren't taking on too much risk in a volatile stock market. That way, you aren't forced to sell investments at a loss to pay your bills.